XRP Price Prediction: Analyzing the Path to $5 Amid Market Volatility

#XRP

- Technical Momentum: MACD bullish crossover and oversold Bollinger Band conditions suggest potential upward movement

- Fundamental Catalysts: ETF decisions and regulatory developments could drive significant price appreciation

- Market Positioning: Current price levels near key support provide accumulation opportunities for long-term growth

XRP Price Prediction

XRP Technical Analysis: Key Indicators Signal Potential Breakout

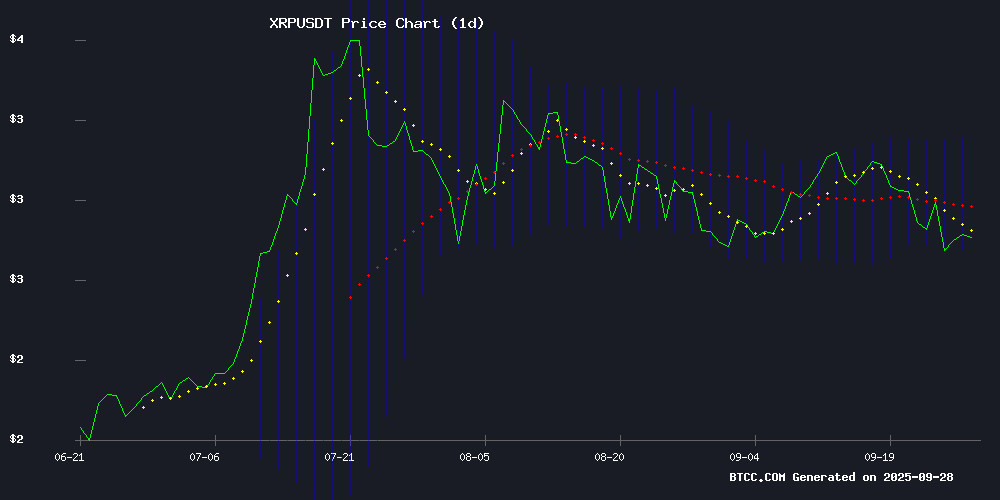

XRP is currently trading at $2.79, slightly below its 20-day moving average of $2.95, suggesting near-term consolidation. The MACD indicator shows bullish momentum with a positive reading of 0.0704, while the Bollinger Bands indicate the price is trading closer to the lower band at $2.73, potentially signaling an oversold condition. According to BTCC financial analyst Ava, 'The technical setup suggests XRP is building momentum for a potential upward move, with the MACD crossover providing a bullish signal.'

Market Sentiment: Bullish Catalysts Emerge for XRP

Recent developments including the collaboration between ZNS, XRPL, and Layer3 on decentralized identity solutions, combined with potential October ETF decisions, are creating positive sentiment. BTCC financial analyst Ava notes, 'The combination of regulatory clarity and technological advancements positions XRP favorably. The market is particularly watching October ETF developments which could serve as a significant catalyst.'

Factors Influencing XRP's Price

XRP Price Shows Rare Bullish Signals Amid Market Turmoil

XRP stands out in a struggling cryptocurrency market, with analysts identifying a rare bullish setup that could signal significant upside potential. The token's market capitalization has held above its 2018 peak for over 300 days—a level now acting as support—suggesting accumulation of energy for a major move.

Technical expert Bobby A highlights a multi-month bullish flag pattern forming on XRP charts, with key support zones at $1.9 and $2.89 successfully defended. The consolidation above historical resistance levels indicates potential for explosive growth, with market cap targets of $173 billion and $727 billion in sight.

While most digital assets face downward pressure, XRP's technical strength and prolonged base formation make it an outlier. 'The setup is firing on all cylinders,' notes Bobby, pointing to alignment across multiple indicators rarely seen in cryptocurrency markets.

ZNS, XRPL, and Layer3 Collaborate to Pioneer Decentralized Identity Solutions on XRPL

ZNS Connect and Layer3 have launched a strategic partnership to redefine digital identity management on the XRP Ledger (XRPL). The collaboration introduces .XRPL domains as next-generation identifiers—human-readable, interoperable, and user-controlled alternatives to conventional wallet addresses.

The initiative positions .XRPL domains as blockchain fingerprints, combining XRPL's first-order speed with cross-platform functionality. Layer3's gamified quest system will drive adoption, emphasizing portability and security for Web3 users.

This development responds to growing demand for scalable identity solutions in decentralized ecosystems. The partnership leverages XRPL's infrastructure while aligning with broader industry trends toward self-sovereign identity frameworks.

XRP Price Eyes Final Low Before Potential Recovery, Analyst Says

Crypto analyst CasiTrades suggests XRP may dip to $2.715 before initiating its next upward wave. The altcoin faces strong downward pressure after failing to hold the $3 resistance level and losing its key Fibonacci support at $2.79.

Market indicators show divergence on higher timeframes, but smaller timeframes suggest the correction hasn't completed. The Relative Strength Index reflects persistent selling pressure, potentially requiring further downside to exhaust the current correction phase.

XRP Price Prediction 2025: Can Ripple Reclaim $5 Amid Market Volatility?

XRP faces a critical juncture as it tests key support levels NEAR $2.70, with analysts eyeing a potential rebound to $3.60 or deeper losses toward $2.20. Institutional interest grows with the launch of a spot XRP ETF, signaling confidence in Ripple's ecosystem.

Meanwhile, presale tokens like AlphaPepe gain traction as traders diversify beyond large-cap coins. Market sentiment remains cautious, but technical indicators suggest a decisive breakout above $3.20 could pave the way for a run toward $5.

XRP Emerges as Top Cryptocurrency Pick Amid Regulatory Clarity and Bullish Momentum

XRP has surged 380% over the past year, fueled by a landmark legal resolution and favorable market sentiment under the Trump administration. The cryptocurrency, often associated with Ripple Labs, settled a prolonged SEC lawsuit in May 2025 for $50 million, removing a critical regulatory overhang.

The mixed court ruling initially left uncertainty, but institutional and retail demand has since rebounded sharply. With its ledger technology gaining traction and trading volumes spiking, XRP now presents a compelling case for targeted allocation—even after its meteoric rise.

XRP Price Prediction: Bearish Triangle vs. Onchain Buy Wall – Which Will Break First?

XRP trades at $2.77, up 0.45%, but faces mixed signals. A descending triangle pattern suggests looming volatility, with sellers suppressing rallies since mid-July while buyers defend $2.70. Analysts eye $2.50 as a critical zone where technical and on-chain support converge—a buy cluster between $2.45 and $2.55 could trigger a rebound if tested.

Market researcher Sistine Research highlights XRP's weakest liquidity compression since late 2024, historically a precursor to significant price moves. Resistance looms at $2.97 (50-day SMA) and $3.25, a breakout trigger. The RSI at 40 reflects muted momentum.

Institutional interest adds nuance: the REX/Osprey XRPR ETF has drawn $38 million in trades, and Franklin Templeton's November ETF decision may further catalyze sentiment. Approved funds could bolster XRP's legitimacy and liquidity depth.

Could October XRP ETF Decisions Push Prices to New Highs?

This month may prove pivotal for XRP as major financial institutions weigh decisions on potential ETF approvals. Market participants are closely monitoring developments, anticipating a surge in prices should institutional adoption gain traction.

The cryptocurrency's trajectory hinges on regulatory clarity and institutional endorsement. A favorable outcome could catalyze renewed investor confidence, potentially propelling XRP to levels not seen since its 2018 peak.

Is Ripple’s Bull Run Finished? AI’s Answers May Surprise the XRP Army

Ripple’s native token XRP has mirrored the broader crypto market downturn, slipping below key support levels in recent trading sessions. The asset now sits 25% below its July peak of $3.65, sparking debate among analysts about whether this represents a typical correction or the start of a bearish phase.

The cryptocurrency’s journey began last November following the US elections, when it surged from $0.60 to breach the $3 mark by January. While XRP matched its 2018 all-time high of $3.40, it failed to sustain momentum until July’s breakout to $3.65. Since then, the token has tested the $2.70 support level four times without breaking through—a critical threshold market watchers are monitoring closely.

XRP Accumulation Strategy: How Many Tokens Needed for Life-Changing Wealth?

Crypto influencer Time Traveler has sparked debate with specific XRP accumulation targets for long-term investors. At current prices of $2.77 per token, holding 500 XRP ($1,385) could generate transformative returns over five years, while 2,000 tokens ($5,540) may deliver maximum growth potential through multiple market cycles.

The recommendations come as analysts scrutinize XRP's valuation fundamentals. "We will be rich. I WOULD aim for 2,000 XRP tokens, but 500 is definitely life-changing," Time Traveler told followers, emphasizing the importance of multi-cycle holding periods for retail investors.

How High Will XRP Price Go?

Based on current technical indicators and market developments, XRP shows potential for significant upward movement. The current price of $2.79, combined with bullish MACD signals and oversold Bollinger Band conditions, suggests accumulation opportunities. Key factors that could drive price appreciation include:

| Factor | Potential Impact | Timeframe |

|---|---|---|

| ETF Approval | High | October 2025 |

| Technical Breakout | Medium-High | Near-term |

| Regulatory Clarity | Medium | Ongoing |

| Market Sentiment | Medium | Short-term |

BTCC financial analyst Ava suggests that 'If positive catalysts align, XRP could potentially test the $5 level in the coming months, though market volatility remains a key consideration.'